Jun. 10 - 12, 2026 Shenzhen Convention and Exhibition Center

Press Center

In a session at this year’s virtual ARC Forum, Andrew Obin of Bank of America offered insights into current and expected software and hardware spending in manufacturing, with a particular focus on implications in the energy sectors.

Author——David Greenfield

Forward from Automation World

While there’s certainly no shortage of trend outlooks for manufacturing technology spending based on near-term plans, looking at where industrial companies have been investing offers interesting insights into where things could be headed.

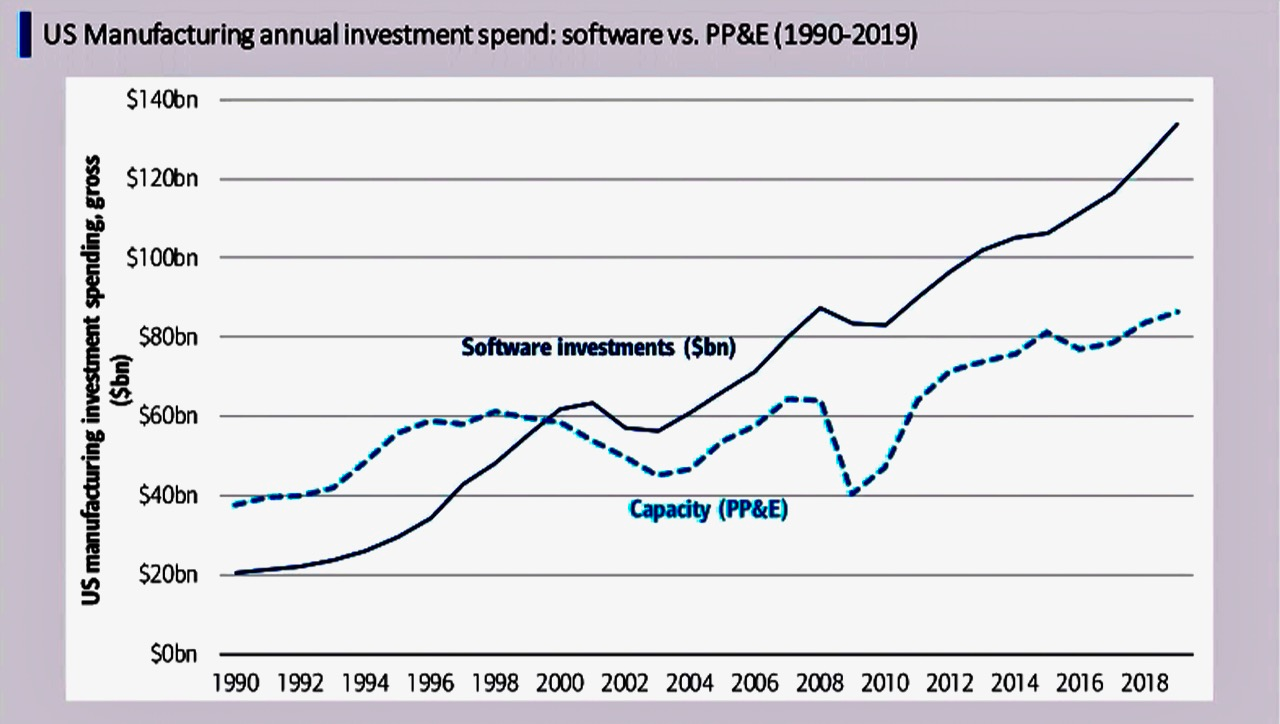

U.S. manufacturing annual investment in software vs. PP&E (property, plant and equipment). Source: Bank of America

According to Andrew Obin, managing director of Bank of America Merrill Lynch Equity Research, one of the biggest trends he’s seen is how spending on software has overtaken hardware spending by U.S. manufacturers. In his presentation at the virtual ARC Forum, Obin noted that, although software spending in 2020 was flat, the fact that spending remained in line with 2019—despite the pandemic—supports the investment firm’s position about the continued strength of software versus hardware spending in industry.

Essentially, what researchers like Obin are seeing play out across industry underscores the trend seen in virtually every business sector—that software has become the predominant technology. Automation World discussed this trend with Michael Risse of data analytics software supplier Seeq in late 2019 for the article “Is Software Eating Industry Yet?”

Obin clarified that much of the manufacturing industries’ spending on software in 2020 focused on enterprise level software, such as enterprise resources planning (ERP), customer relationship management (CRM), and supply chain management (SCM) than on specific manufacturing floor software. However, he noted that industry’s spending on software supports “one of the most powerful stories in U.S. manufacturing over the past 20 years—the significant margin expansion [of the industry] despite big offshoring trends in the U.S. [during that period]. Even though we didn't have growth in the U.S. [manufacturing industries], the [industry’s] software investment has enabled very significant improvements in the profitability of U.S. manufacturing operations over the past 20 years as focus shifted away from growth and more toward efficiency.”

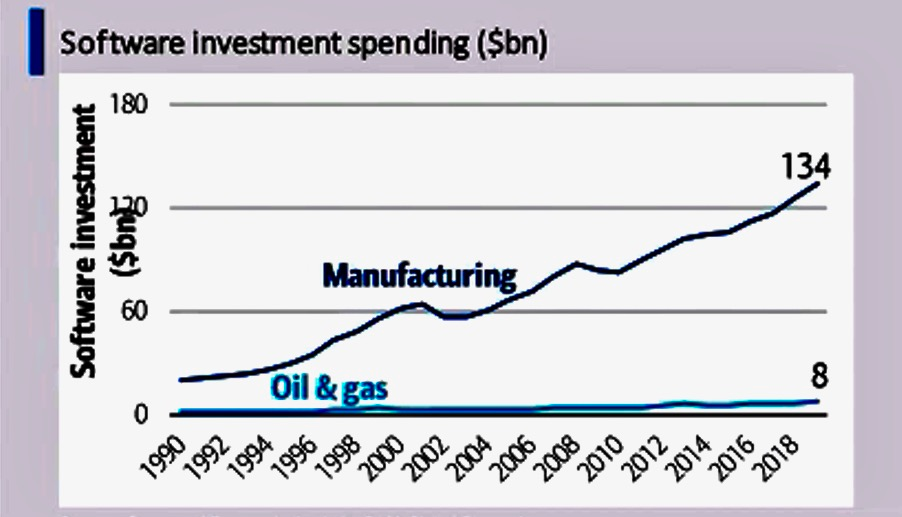

Diverging from the manufacturing industries’ overall spending on technology is the lack of spending on such technologies by the energy sector. Obin’s data shows that, in 2019, manufacturing as a whole spent $228 billion on plants and equipment, while oil and gas spent $174 billion. More striking was the disparity in software spending between manufacturing and the oil & gas sector. In 2019 the oil & gas sector spent $8 billion on software while the manufacturing industry spent $134 billion.

Comparison of software investment spending in manufacturing versus oil and gas. Source: Bank of America

The oil and gas industry has sort of done the opposite of the manufacturing industry, said Obin, noting how oil and gas spending on technology declined even as oil prices recovered. “It's remarkable just how little oil and gas industry is spending today,” Obin said. “[But] if the oil and gas industry focused more on efficiency and less on growth in the new post-pandemic world—where we have more focus on green [initiatives]—it could present a revolutionary opportunity for the industry.”

Exhibition contact

For Exhibitors:

Hannover Milano Fairs Shanghai Ltd. Guangzhou Branch

Rm.1510, West Tower, Poly World Trade Center, No.1000 Xingang East Road, Haizhu District, Guangzhou, China 510308

Fax:86-20-38795750

Ms. Jessica Lin / Ms. Kelly Sun/ Ms. Linda Han

Tel:86 20 86266696 ext.8018/8016/8020

E-mail:Jessica.lin@hmf-china.com

Kelly.sly@hmf-china.com

Linda.han@hmf-china.com

Hannover Milano Fairs Shanghai Ltd.

15F, Tower A, Infun World, No.308 Lanhua Rd, Pudong New District, Shanghai, China

Mr. David Zhang

Tel:+86 21 2055 7128

Fax:+86 21 2055 7100

Email:David.zhang@hmf-china.com

Hannover Fairs International GmbH

Messengelande 30521 Hannover, Germany

Contact:Mr. Simone Robering

Tel:+49 511 89-31281

Email:Simone.Robering@messe.de

Contact:Ms. Anna Buschmann

Tel:+49 511 89-31292

Email: Anna.Buschmann@messe.de

For Visitors:

Mr. Zack Jiang

Tel:+86 21 2055 7156

E-mail:Zack.jiang@hmf-china.com

Ms. Cindy Huang

Tel:86 20 86266696 ext.8015

E-mail:Cindy.huang@hmf-china.com

Skype:cindyhuang_hmf

Media Cooperation

Industrial-Automation:

Mr. Zack Jiang

Tel:+86 21 2055 7156

Email:Zack.jiang@hmf-china.com

Machine Vision:

Ms. Alice Li

Tel:+86 20 86266696 ext.8046

Email:Alice.li@hmf-china.com

Ms. Jessica Lin

Tel:86 20 86266696 ext.8018

E-mail:Jessica.lin@hmf-china.com

Skype:jessicalin_hmf

Ms. Kelly Sun

Tel:86 20 86266696 ext.8016

E-mail:Kelly.sly@hmf-china.com

Skype:kellysly_hmf